how to get income tax number malaysia

Registering for a Malaysian tax number is not very complicated. Taxpayers who already have an income tax number do not need to apply for a TIN while those who have income but are not eligible for tax payment must submit an income tax.

Aw Partner Consultancy New Income Tax Number Tax Identification Number Tin 推行税务识别码 快来查看您的tin Now You May Check Income Tax Number For Individuals Via Online At Below Link Https Edaftar Hasil Gov My Semaknocukai Index Php

You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready.

. Your income tax refund will be done through. Confused About US Expat Taxes. Choose your identification type New.

Download Other files in Income Tax category. Two copies of Form 49 Name and the address of. Obtaining a Federal Tax Identification Number Visit the official website of the Inland Revenue Board of Malaysia.

Assume you work in Malaysia Dec08 to Jun09 and the money you get from Singapore remain. A copy of identification cardpassport of the applicants. THEN choose your preferred search criteria BVN NIN or registered number from the.

How can I check my income tax number online Malaysia. Generally employers obtain income tax numbers from the IRB on behalf of their expat employees. The Inland Revenue Board of Malaysia Malay.

Access Top US Expat Tax Service In Minutes. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. After that you can obtain your PIN online or by visiting a LHDN branch.

August 2022 On. However it is also possible for individuals to get their tax file numbers from. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing.

Ad Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats. Obtaining an Income Tax Number Visit the official Inland Revenue Board of Malaysia website. 19 September 2022 Download.

Once the new page has loaded click on the relevant income tax. Once you receive your tax reference number you can proceed to fill in your income tax form but if its your first time you should spend some time to figure out which tax category. When u submit your borang BE the IRD will open a file income tax number for you.

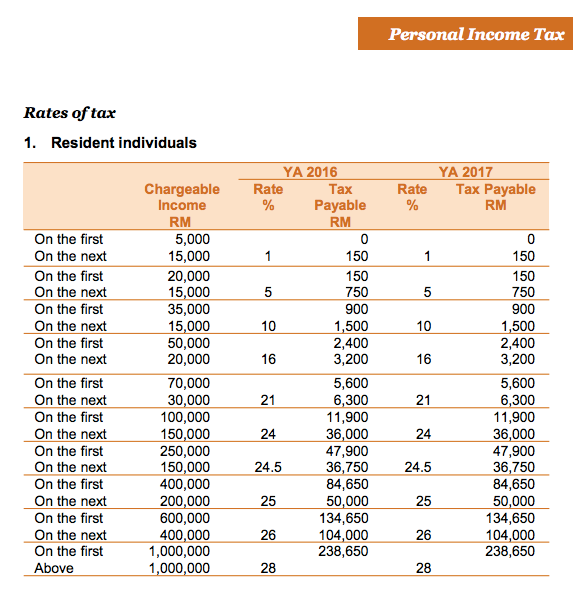

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Type of File Number 2 alphabets characters SG or OG space Income Tax Number maximum 11. Now that youre registered with LHDN the next.

RBI Bulletin - September. Access Top US Expat Tax Service In Minutes. Forward the following documents together with the application form to register an income tax reference number E-number- 1.

Once you have the PIN head on to the e-Filing website and click on First Time Login. The Type of File Number and the Income Tax Number. Therell be a text box to enter your PIN.

Lets take a look at the registration steps. Login to e-Filing and complete first-time login. It takes just four steps to complete your income tax number registration.

THEN enter your date of birth. Share Report Trending Downloads. Example for Individual File Number.

03-8911 1000 Local number 03-8911 1100 Overseas number Not registered. Two copies of Form 13 Change of company name if applicable 4. The most common tax reference types are SG OG D and C.

FIRST go to the Joint Tax Boards verification portal. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. You can do the registration either on-line or at the nearest branch of the Malaysian Inland Revenue Board IRBM Lembaga Hasil.

Normally companies will obtain the income tax. Ad Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats. To get your income tax number youll need to first register as a taxpayer on e-Daftar.

Confused About US Expat Taxes. Within 3 working days youll get an e-mail from LHDN stating that you have been registered and you will receive your tax number. Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type.

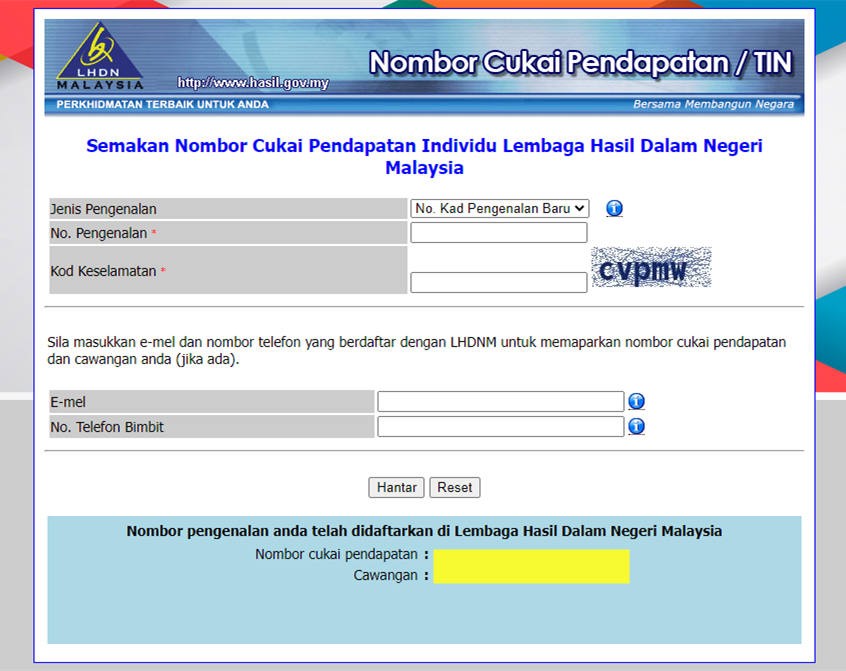

To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp. Visit LHDN Website LHDN website. Two copies of Form 9 Certificate of Registration from CCM.

PIN number First time Login can be obtained through HASiL Customer Feedback Form on the Official Portal or walk in to HASiL branches.

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Never Filed Income Tax Before Here S A Simple Guide On How To Do It Online World

Tips For Income Tax Saving L Co Chartered Accountants

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Tax Identification Number Tin L Co Accountants

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

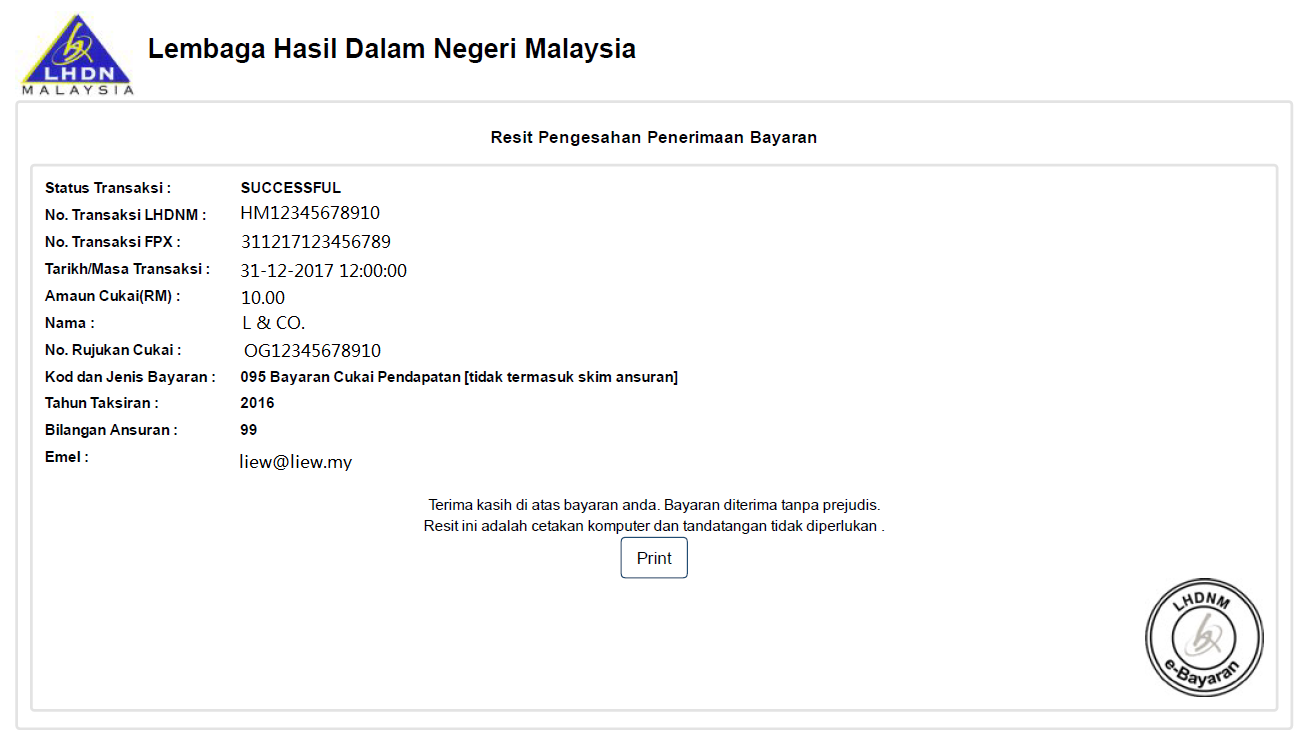

How To Check Income Tax Number Malaysia Online

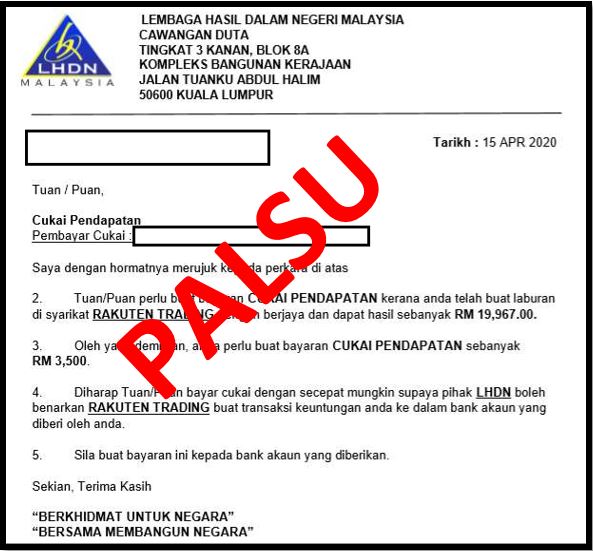

Beware Of Tax Scams Lembaga Hasil Dalam Negeri Malaysia

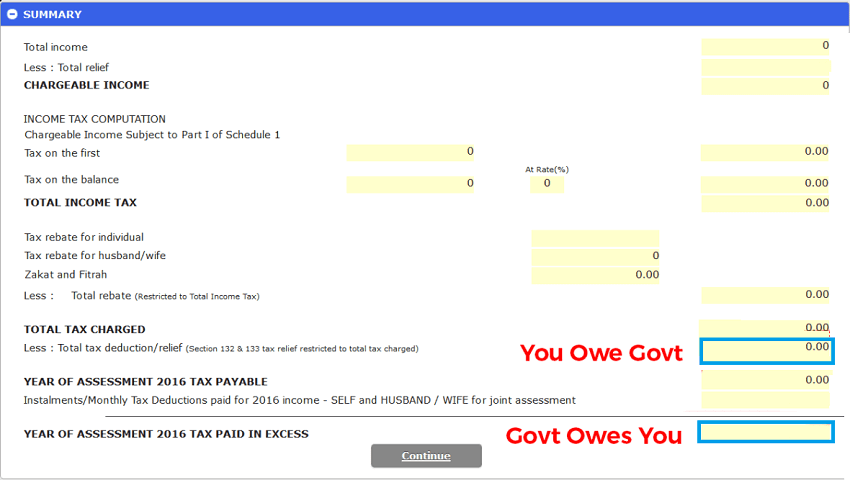

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

How To Step By Step Income Tax E Filing Guide Imoney

Income Tax Everything They Should Have Taught Us In School The Full Frontal

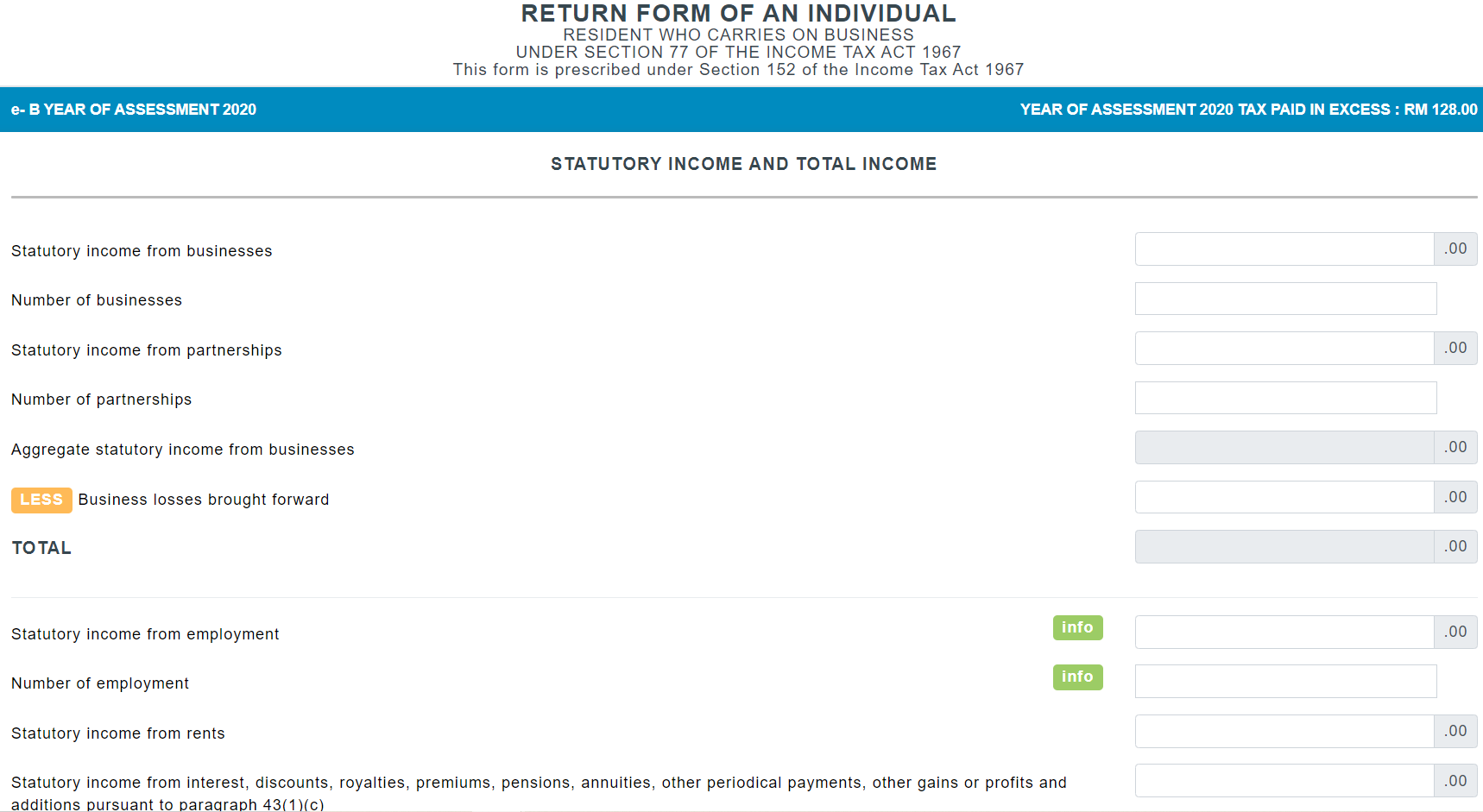

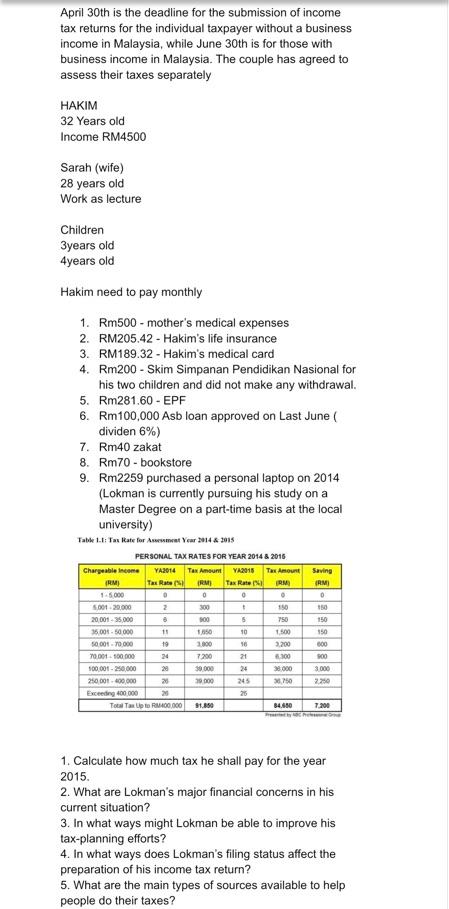

April 30th Is The Deadline For The Submission Of Chegg Com

How To Check Your Income Tax Number And Tax Identification Number Leh Leo Radio News

7 Tips To File Malaysian Income Tax For Beginners

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Ctos Lhdn E Filing Guide For Clueless Employees

Agreement Between Malaysia And The Federal Republic Of Germany

Comments

Post a Comment